Tax

Summary of the Law on Harmonization of Tax Regulations

The following is a summary of Law Number 7 of 2021 Harmonization of Tax Regulations:

INCOME TAX

1. Changes in rates and brackets for personal income tax, so that it is more

reflects justice

2. Imposition of taxes on nature

Giving in kind to employees can be financed by the employer

and is income for employees. Certain nature isn't it

is income for the recipient:

a. Provision of food/drink for all employees

b. Nature in certain areas

c. In nature because of the necessity of work, for example: work safety tools

or uniform

d. Natura sourced from the APBN/APBD

e. Nature with certain types and limitations.

3. The gross turnover limit is not subject to tax for individual taxpayers

-. For private entrepreneurs who calculate PPh with final rates

0.5% (PP 23/2018) and has a gross turnover of up to Rp 500 million

a year is not subject to PPh.

4. Corporate income tax rates

The corporate income tax rate is fixed at 22%, which applies to

fiscal year 2022 and beyond.

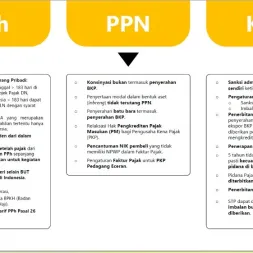

VALUE-ADDED TAX

1. Exemption of VAT objects and VAT facilities

a. VAT exemption facility is provided for goods needed

basic services, health services, educational services, social services, and

several other types of services. Middle-income people

and small still do not need to pay VAT on consumption needs

basic services, education services, health services, and social services.

b. Reductions on VAT exemptions and facilities are provided so that

reflects justice and is right on target, as well as consistently

protect the interests of society and the business world.

This arrangement is intended for a permanent expansion of the VAT base

considering the principle of justice, the principle of expediency, especially in

promote the general welfare and the principle of national interest. Destination

This policy is the optimization of state revenues by continuously

realizing a just and certain taxation system

law.

2. Changes in VAT rates

a. General Rate

Starting April 1, 2022 the VAT rate applies to 11% which was previously 10

%. Where to apply the 12% tariff at the latest

January 1, 2025

b. Special Rate

For convenience in collecting VAT, on the type of goods/services

certain business sectors or certain business sectors, the 'final' VAT rate is applied, for example

1%, 2% or 3% of business circulation, which is regulated by PMK.

MATERIALS OF GENERAL PROVISIONS AND TAXATION PROCEDURES

1. Use of NIK as an individual NPWP

-. Integration of population database with administrative system

taxation aims to make it easier for individual taxpayers to carry out

fulfillment of tax rights and obligations for simplicity

administration and national interest.

-. The use of NIK as NPWP does not necessarily cause

each individual pays taxes. Tax payments are made

if:

a. Annual income above the PTKP limit; or

b. Gross turnover above IDR 500 million/year for entrepreneurs who

pay 0.5% Final PPh (PP-23/2018).

2. Amount of Sanctions at the time of examination and sanctions in legal remedies

For justice and legal certainty, sanctions have been reduced for

during examination and sanctions in legal proceedings. This is also in line

with the spirit of regulation in the Job Creation Act.

3. Taxpayer's power of attorney

For justice and legal certainty, the Taxpayer's attorney may

carried out by anyone, as long as it meets the competency requirements

mastering taxation. Exceptions are granted if the power of attorney

the person appointed is a husband, wife, or blood relative 2

(two) degrees.

INCOME TAX

1. Changes in rates and brackets for personal income tax, so that it is more

reflects justice

2. Imposition of taxes on nature

Giving in kind to employees can be financed by the employer

and is income for employees. Certain nature isn't it

is income for the recipient:

a. Provision of food/drink for all employees

b. Nature in certain areas

c. In nature because of the necessity of work, for example: work safety tools

or uniform

d. Natura sourced from the APBN/APBD

e. Nature with certain types and limitations.

3. The gross turnover limit is not subject to tax for individual taxpayers

-. For private entrepreneurs who calculate PPh with final rates

0.5% (PP 23/2018) and has a gross turnover of up to Rp 500 million

a year is not subject to PPh.

4. Corporate income tax rates

The corporate income tax rate is fixed at 22%, which applies to

fiscal year 2022 and beyond.

VALUE-ADDED TAX

1. Exemption of VAT objects and VAT facilities

a. VAT exemption facility is provided for goods needed

basic services, health services, educational services, social services, and

several other types of services. Middle-income people

and small still do not need to pay VAT on consumption needs

basic services, education services, health services, and social services.

b. Reductions on VAT exemptions and facilities are provided so that

reflects justice and is right on target, as well as consistently

protect the interests of society and the business world.

This arrangement is intended for a permanent expansion of the VAT base

considering the principle of justice, the principle of expediency, especially in

promote the general welfare and the principle of national interest. Destination

This policy is the optimization of state revenues by continuously

realizing a just and certain taxation system

law.

2. Changes in VAT rates

a. General Rate

Starting April 1, 2022 the VAT rate applies to 11% which was previously 10

%. Where to apply the 12% tariff at the latest

January 1, 2025

b. Special Rate

For convenience in collecting VAT, on the type of goods/services

certain business sectors or certain business sectors, the 'final' VAT rate is applied, for example

1%, 2% or 3% of business circulation, which is regulated by PMK.

MATERIALS OF GENERAL PROVISIONS AND TAXATION PROCEDURES

1. Use of NIK as an individual NPWP

-. Integration of population database with administrative system

taxation aims to make it easier for individual taxpayers to carry out

fulfillment of tax rights and obligations for simplicity

administration and national interest.

-. The use of NIK as NPWP does not necessarily cause

each individual pays taxes. Tax payments are made

if:

a. Annual income above the PTKP limit; or

b. Gross turnover above IDR 500 million/year for entrepreneurs who

pay 0.5% Final PPh (PP-23/2018).

2. Amount of Sanctions at the time of examination and sanctions in legal remedies

For justice and legal certainty, sanctions have been reduced for

during examination and sanctions in legal proceedings. This is also in line

with the spirit of regulation in the Job Creation Act.

3. Taxpayer's power of attorney

For justice and legal certainty, the Taxpayer's attorney may

carried out by anyone, as long as it meets the competency requirements

mastering taxation. Exceptions are granted if the power of attorney

the person appointed is a husband, wife, or blood relative 2

(two) degrees.