Insight

25 July 2022

Summary of the Law on Harmonization of Tax RegulationsThe following is a summary of Law Number 7 of 2021 Harmonization of Tax Regulations:

INCOME TAX

1. Changes in rates and brackets for personal income tax, so that it is more

reflects justice

2. Imposition of taxes on nature

Giving in kind to employees can be financed by the employer

and is income for employees. Certain nature isn't it

is income for the recipient:

a. Provision of food/drink for all employees

b. Nature in certain areas

c. In nature because of the necessity of work, for example: work safety tools

or uniform

d. Natura sourced from the APBN/APBD

e. Nature with certain types and limitations.

3. The gross turnover limit is not subject to tax for individual taxpayers

-. For private entrepreneurs who calculate PPh with final rates

0.5% (PP 23/2018) and has a gross turnover of up to Rp 500 million

a year is not subject to PPh.

4. Corporate income tax rates

The corporate income tax rate is fixed at 22%, which applies to

fiscal year 2022 and beyond.

VALUE-ADDED TAX

1. Exemption of VAT objects and VAT facilities

a. VAT exemption facility is provided for goods needed

basic services, health services, educational services, social services, and

several other types of services. Middle-income people

and small still do not need to pay VAT on consumption needs

basic services, education services, health services, and social services.

b. Reductions on VAT exemptions and facilities are provided so that

reflects justice and is right on target, as well as consistently

protect the interests of society and the business world.

This arrangement is intended for a permanent expansion of the VAT base

considering the principle of justice, the principle of expediency, especially in

promote the general welfare and the principle of national interest. Destination

This policy is the optimization of state revenues by continuously

realizing a just and certain taxation system

law.

2. Changes in VAT rates

a. General Rate

Starting April 1, 2022 the VAT rate applies to 11% which was previously 10

%. Where to apply the 12% tariff at the latest

January 1, 2025

b. Special Rate

For convenience in collecting VAT, on the type of goods/services

certain business sectors or certain business sectors, the 'final' VAT rate is applied, for example

1%, 2% or 3% of business circulation, which is regulated by PMK.

MATERIALS OF GENERAL PROVISIONS AND TAXATION PROCEDURES

1. Use of NIK as an individual NPWP

-. Integration of population database with administrative system

taxation aims to make it easier for individual taxpayers to carry out

fulfillment of tax rights and obligations for simplicity

administration and national interest.

-. The use of NIK as NPWP does not necessarily cause

each individual pays taxes. Tax payments are made

if:

a. Annual income above the PTKP limit; or

b. Gross turnover above IDR 500 million/year for entrepreneurs who

pay 0.5% Final PPh (PP-23/2018).

2. Amount of Sanctions at the time of examination and sanctions in legal remedies

For justice and legal certainty, sanctions have been reduced for

during examination and sanctions in legal proceedings. This is also in line

with the spirit of regulation in the Job Creation Act.

3. Taxpayer's power of attorney

For justice and legal certainty, the Taxpayer's attorney may

carried out by anyone, as long as it meets the competency requirements

mastering taxation. Exceptions are granted if the power of attorney

the person appointed is a husband, wife, or blood relative 2

(two) degrees.

INCOME TAX

1. Changes in rates and brackets for personal income tax, so that it is more

reflects justice

2. Imposition of taxes on nature

Giving in kind to employees can be financed by the employer

and is income for employees. Certain nature isn't it

is income for the recipient:

a. Provision of food/drink for all employees

b. Nature in certain areas

c. In nature because of the necessity of work, for example: work safety tools

or uniform

d. Natura sourced from the APBN/APBD

e. Nature with certain types and limitations.

3. The gross turnover limit is not subject to tax for individual taxpayers

-. For private entrepreneurs who calculate PPh with final rates

0.5% (PP 23/2018) and has a gross turnover of up to Rp 500 million

a year is not subject to PPh.

4. Corporate income tax rates

The corporate income tax rate is fixed at 22%, which applies to

fiscal year 2022 and beyond.

VALUE-ADDED TAX

1. Exemption of VAT objects and VAT facilities

a. VAT exemption facility is provided for goods needed

basic services, health services, educational services, social services, and

several other types of services. Middle-income people

and small still do not need to pay VAT on consumption needs

basic services, education services, health services, and social services.

b. Reductions on VAT exemptions and facilities are provided so that

reflects justice and is right on target, as well as consistently

protect the interests of society and the business world.

This arrangement is intended for a permanent expansion of the VAT base

considering the principle of justice, the principle of expediency, especially in

promote the general welfare and the principle of national interest. Destination

This policy is the optimization of state revenues by continuously

realizing a just and certain taxation system

law.

2. Changes in VAT rates

a. General Rate

Starting April 1, 2022 the VAT rate applies to 11% which was previously 10

%. Where to apply the 12% tariff at the latest

January 1, 2025

b. Special Rate

For convenience in collecting VAT, on the type of goods/services

certain business sectors or certain business sectors, the 'final' VAT rate is applied, for example

1%, 2% or 3% of business circulation, which is regulated by PMK.

MATERIALS OF GENERAL PROVISIONS AND TAXATION PROCEDURES

1. Use of NIK as an individual NPWP

-. Integration of population database with administrative system

taxation aims to make it easier for individual taxpayers to carry out

fulfillment of tax rights and obligations for simplicity

administration and national interest.

-. The use of NIK as NPWP does not necessarily cause

each individual pays taxes. Tax payments are made

if:

a. Annual income above the PTKP limit; or

b. Gross turnover above IDR 500 million/year for entrepreneurs who

pay 0.5% Final PPh (PP-23/2018).

2. Amount of Sanctions at the time of examination and sanctions in legal remedies

For justice and legal certainty, sanctions have been reduced for

during examination and sanctions in legal proceedings. This is also in line

with the spirit of regulation in the Job Creation Act.

3. Taxpayer's power of attorney

For justice and legal certainty, the Taxpayer's attorney may

carried out by anyone, as long as it meets the competency requirements

mastering taxation. Exceptions are granted if the power of attorney

the person appointed is a husband, wife, or blood relative 2

(two) degrees.

26 June 2022

Summary of Law Number 11 of 2020 concerning Cluster Job Creation in the field of taxationIn accordance with Law Number 11 of 2020 concerning Job Creation with a thickness of 1,187 pages, it has been effective since November 2, 2020.

Updates

Thus Decision Number 91/PUU-XVIII/2020 was read out in the verdict hearing which was held on Thursday (11/25/2021) afternoon. In the Decision Order read by the Chief Justice of the Constitutional Court Anwar Usman, the Court partially granted the petition filed by Migrant CARE, the Coordination Board for the Customary Density of West Sumatra Nagari, the Minangkabau Customary Court, and Muchtar Said.

"Declare that the establishment of the Job Creation Law is contrary to the 1945 Constitution and does not have conditionally binding legal force as long as it does not mean 'no corrections have been made within 2 (two) years since this decision was pronounced'. Stating that the Job Creation Law remains in effect until the formation is corrected in accordance with the grace period as determined in this decision," said Anwar, who was accompanied by eight other constitutional judges on that occasion.

In the 448-page decision, the Court also ordered the legislators to make improvements within a maximum period of 2 (two) years after the decision was pronounced. If within that time limit no corrections are made, then the Job Creation Law is declared permanently unconstitutional. (source: www.mkri.id)

Updates

Thus Decision Number 91/PUU-XVIII/2020 was read out in the verdict hearing which was held on Thursday (11/25/2021) afternoon. In the Decision Order read by the Chief Justice of the Constitutional Court Anwar Usman, the Court partially granted the petition filed by Migrant CARE, the Coordination Board for the Customary Density of West Sumatra Nagari, the Minangkabau Customary Court, and Muchtar Said.

"Declare that the establishment of the Job Creation Law is contrary to the 1945 Constitution and does not have conditionally binding legal force as long as it does not mean 'no corrections have been made within 2 (two) years since this decision was pronounced'. Stating that the Job Creation Law remains in effect until the formation is corrected in accordance with the grace period as determined in this decision," said Anwar, who was accompanied by eight other constitutional judges on that occasion.

In the 448-page decision, the Court also ordered the legislators to make improvements within a maximum period of 2 (two) years after the decision was pronounced. If within that time limit no corrections are made, then the Job Creation Law is declared permanently unconstitutional. (source: www.mkri.id)

24 June 2022

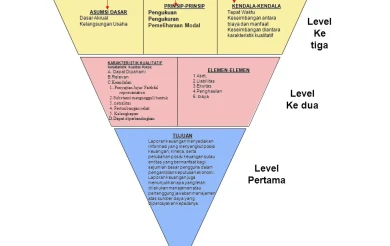

The objective of the financial statements is in accordance with the basic framework for the preparation and presentation of financial statementsThe purpose of financial statements in accordance with the basic framework for the preparation and presentation of financial statements is to provide information regarding the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions.

Financial statements prepared for this purpose meet the common needs of most users. However, financial statements do not provide all the information that users may need in making economic decisions because they generally reflect the financial effects of past events, and are not required to provide non-financial information.

The financial statements also show what management has done

(stewardship), or management's responsibility for the resources entrusted to it. Users who wish to assess what has been done or the responsibility of management do so so that they can make economic decisions; these decisions may include, for example, decisions to hold or sell their investment in the company or decisions to reappoint or replace management.

Financial statements prepared for this purpose meet the common needs of most users. However, financial statements do not provide all the information that users may need in making economic decisions because they generally reflect the financial effects of past events, and are not required to provide non-financial information.

The financial statements also show what management has done

(stewardship), or management's responsibility for the resources entrusted to it. Users who wish to assess what has been done or the responsibility of management do so so that they can make economic decisions; these decisions may include, for example, decisions to hold or sell their investment in the company or decisions to reappoint or replace management.